The last few weeks have been disorienting. I have been through recessions before and this feels only slightly different. Yet people really seem to believe – and to want to believe – it is the end of capitalism. To me there is only one difference to previous recessions; the level of debt (both public and private) with which it begins – at least in Britain.

The insane level of personal debt (and the loss of fear of debt) which has left Britain the most indebted of the G8 countries means that ours will be deeper and more miserable than others’. While the Toynbees of this world sneer at Americans, whose debts average about 140% of disposable income vs the already deplorable 105% before this debt binge began, they fail to mention that for the average Brit (not forgetting that many of us are solvent) it’s more than 170%. Until about 500 billion of excessive debt is paid down, British consumers are hors de combat economique. Yet still the Government talks as if, if it can only take enough from the prudent minority to get the banks up and running again, the insanity could resume.

That is the last thing that should happen. Where is the Thatcher figure to tell us that we can neither pay ourselves more than we earn, nor borrow more than we can repay?

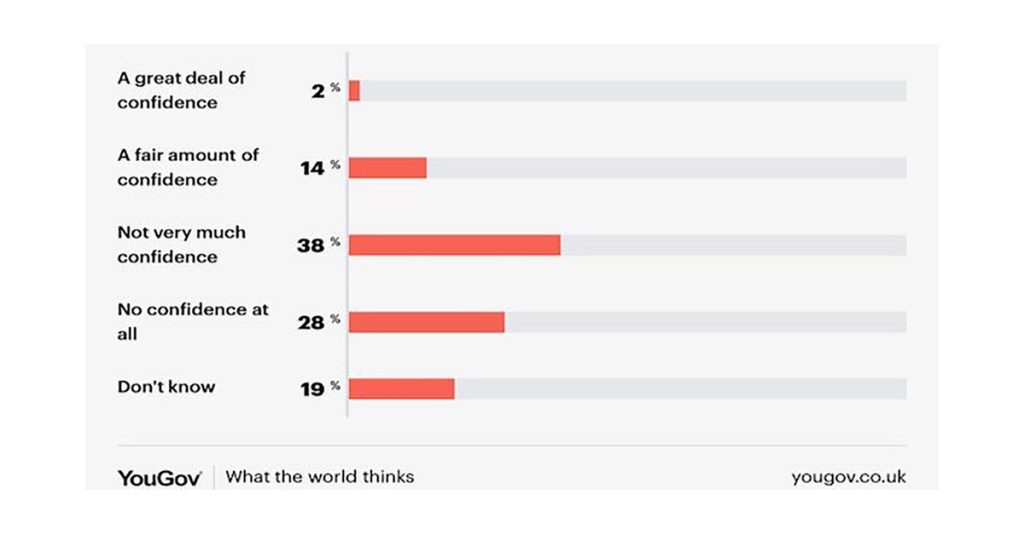

Meanwhile, though the cause of the crisis is Carol Voorderman economics, the Left is blaming lack of regulation. Only people who have never worked with banks could delude themselves thus. The truth is they were highly regulated by the sort of second-raters who take public sector jobs. Increasing regulation will solve nothing, because regulators will always be outthought by highly incentivized, ambitious and intelligent people. Even now, some governments are lowering capital requirements for banks to allow them to lend more. How cretinous is that?

The problem is one of perverse incentives. Rather than being bailed out by the public purse, the shareholders who chose directors too stupid to understand the complex products developed by the young geniuses they employed should be taking the consequences. Depositors who trusted banks with more money than was covered by guarantee schemes should be losing that money so that future generations will learn greater prudence.

All they are learning now is not to worry about why an Internet bank offers implausibly higher interest because -if it all goes wrong – even if the obscure country where the bank is based had either not collected the Guarantee Fund contributions from the banks, or had spent them on other things, their government will steal the money from the wise to give it to the foolish.

What you reward, you get more of. The West is rewarding fecklessness and that is what it will get.

Leave a comment